The term “corporate strategy” is often thrown around with the same reverence as a magician’s wand. Corporate strategy isn’t just about boardroom buzzwords; it’s the chess game of business. Every move, from product launches to market expansions, is part of a grand plan for success. But what does it actually mean, and why is it so crucial? Let’s dive into the heart of this concept, stripping away the mystique and jargon, and explore how it shapes the trajectory of large corporations.

What is Corporate Strategy, and Why Does it Matter?

At its core, it is the overarching game plan that defines a company’s direction and scope. Essentially, figuring out where to play (which industries to compete in) and how to win (the competitive advantages to pursue).

Why does corporate strategy matter? To put it simply, it provides direction and focus. With relentless competition and disruptive innovation, companies without a clear strategy risk becoming a rudderless ship, drifting aimlessly in the currents of the market. A well-crafted corporate strategy, on the other hand, provides a sense of purpose and direction, enabling companies to make informed decisions and stay ahead of the curve.

A well-crafted corporate strategy helps:

- Allocate Resources Effectively: A company’s resources (financial, human, technological) are finite. Corporate strategy helps prioritise investments and ensure they are aligned with the overall goals.

- Create Synergies: Multi-business companies can leverage their diverse portfolio to create synergies – the “1+1=3” effect (explained later). Corporate strategy helps identify and exploit these synergies.

- Build Competitive Advantage: Sustainable competitive advantage is the holy grail of business. Corporate strategy helps identify and develop unique capabilities that set a company apart.

- Navigate Uncertainty: The business environment is constantly changing. A robust corporate strategy helps anticipate and respond proactively to these changes.

An Example of Corporate Strategy in Action

Let’s look at a real-world example. Consider The Walt Disney Company. Its corporate strategy is centred around creating and monetising intellectual property (IP) across a diverse range of businesses, including media networks, theme parks, consumer products, and studio entertainment.

This strategy allows Disney to create a virtuous cycle:

- Create Compelling IP: Disney invests heavily in creating beloved characters and stories that resonate with audiences worldwide.

- Leverage IP Across Businesses: The same IP is then used to create multiple revenue streams – a movie becomes a theme park attraction, merchandise, a video game, etc.

- Reinforce Brand Image: The consistent use of IP across different businesses strengthens the Disney brand creates a powerful emotional connection with consumers.

The result is a synergistic effect, where each business unit not only generates its own revenue, but also enhances the value of the company’s IP portfolio. This creates a formidable competitive advantage, as Disney’s IP is not only valuable but also extremely difficult to replicate.

Furthermore, this strategy provides Disney with resilience in the face of changing market conditions. If one business unit faces challenges, others can compensate, ensuring the company’s overall stability and long-term growth prospects.

In conclusion, The Walt Disney Company’s corporate strategy is a compelling illustration of how effectively aligning a company’s activities around a core value proposition can lead to sustainable competitive advantage and long-term success.

The Ansoff Matrix:

The Ansoff Matrix serves as a valuable tool for strategic planning and decision-making. It provides a framework for businesses to identify growth opportunities based on their products and markets:

The Ansoff Matrix is a powerful tool that helps businesses strategize their growth by considering different combinations of products and markets. It provides a clear visual representation of four strategic options and their associated risks, enabling businesses to make informed decisions about their future direction. In other words, it helps businesses figure out where to go next and how risky that might be.

The Ansoff Matrix is divided into four quadrants, each representing a different growth strategy:

Market Penetration Quadrant:

This strategy focuses on increasing sales of existing products in existing markets. It’s the least risky option, as the business operates in a familiar environment with familiar products. Tactics could include price adjustments, increased marketing efforts, or improving distribution channels. However, pushing even more funding in an area that may already be struggling for you has its own major risks and you need to assess whether and why you think the market will care to pay more attention to your products as well as assess whether you’re choosing this strategy to avoid product innovation.

Product Development Quadrant:

This strategy involves developing new products for existing markets. It carries a moderate risk, as the business is introducing something new while still targeting its current customer base. Tactics might include launching new product lines, upgrading existing products, or offering innovative solutions. Think of it as giving your existing customers something fresh to try.

Market Development Quadrant:

This strategy focuses on introducing existing products into new markets. It carries a moderate level of risk, as the business enters uncharted territory with its existing offerings. Tactics could include expanding geographically, targeting new customer segments, or entering new sales channels. It’s taking your tried-and-true products to new places.

Diversification Quadrant:

This strategy involves developing new products for new markets. It’s the riskiest option, as the business is venturing into unfamiliar territory with unfamiliar products. Tactics could include acquiring new businesses, developing entirely new product lines, or entering completely new industries. This is the big leap, the one with the most potential, but also the most uncertainty.

How to Use the Ansoff Matrix:

Start by diving deep into your current products and markets. Understanding your strengths and weaknesses is key. Then, use the matrix as a springboard to explore potential avenues for growth in each quadrant. It’s crucial to weigh the potential risks and rewards associated with each strategy. Here are the ideal steps:

- Analyse Current Situation: Begin by assessing your current products and markets to understand your strengths and weaknesses.

- Identify Growth Opportunities: Use the matrix to brainstorm potential growth opportunities in each quadrant.

- Evaluate Risks and Rewards: Assess the potential risks and rewards associated with each strategy.

- Choose the Right Strategy: Select the strategy that best aligns with your business goals, resources, and risk tolerance.

- Develop an Action Plan: Create a detailed plan outlining the steps needed to implement your chosen strategy.

Why is the Ansoff Matrix so widely used?

It systematically visualises growth options, facilitates analysis, guides resource allocation and supports risk management. I.e. it provides a clear visual representation of the four main growth strategies, helping businesses understand their options and associated risks. Furthermore,It encourages companies to systematically analyse their products, markets, and capabilities to identify suitable growth opportunities.

Accordingly, businesses can make informed decisions about where to invest their resources based on the potential returns and risks of different strategies. Also, it highlights the inherent risks of different growth strategies, enabling companies to develop contingency plans and mitigate potential downsides.

In essence, the Ansoff Matrix’s enduring popularity lies in its simplicity, versatility, and effectiveness. It provides a structured, yet flexible, framework that can be adapted to any business, empowering them to chart a course towards sustainable growth in an increasingly competitive marketplace. It’s no wonder it remains a cornerstone of strategic planning for businesses of all sizes and industries.

Unveiling the Types of Corporate Strategy

Corporate strategies come in various flavours, each with its own unique characteristics and implications:

Growth Strategies

- Focus: Expansion of company operations, market share, and revenue.

- Methods: Organic growth (internal development, increasing sales, entering new markets) and inorganic growth (mergers, acquisitions, strategic alliances).

- Growth strategies are directly linked to the Ansoff Matrix (section on this above):

- Market Penetration: Increase sales of existing products in existing markets. This is the least risky strategy, but often requires significant marketing and sales efforts.

- Market Development: Introduce existing products into new markets. This can involve expanding into new geographic regions or targeting new customer segments.

- Product Development: Develop new products for existing markets. This strategy relies on innovation and R&D to create products that appeal to the company’s current customer base.

- Diversification: Enter new markets with new products. This is the riskiest strategy, as it involves venturing into unfamiliar territory.

Stability Strategies

- Focus: Maintaining the company’s current position and performance.

- When used: Mature industries, uncertain economic conditions, or after a period of rapid growth.

Retrenchment Strategies

- Focus: Downsizing, restructuring, or divesting parts of the business.

- When used: Declining performance, financial difficulties, or a need to focus on core competencies.

Combination Strategies

- Focus: Blending different strategies to suit the needs of a complex, diversified business.

- When used: Large corporations operating in multiple markets and industries.

- A conglomerate might use the Ansoff Matrix (explained previously) to guide its strategies for different business units. One unit might pursue market penetration, while another focuses on product development.

The 4 Pillars of Corporate Strategy

A robust corporate strategy focuses on several key pillars. These can be broken down into additional further pillars. There can be some overlapping concepts, and different people may name some differently, but to avoid confusion, here are the essential 4 pillars:

Visioning: Define a clear vision and mission, setting the direction for the company’s growth.

Setting Objectives: Establish measurable goals and strategic objectives that align with the vision and mission.

Resource Allocation: Effectively allocate capital and human resources to support the strategic objectives.

Prioritisation: Make trade-offs, balance risks and opportunities to achieve the optimal mix for success.

Let’s unpack these pillars:

1. Visioning: The North Star

Think of this as the company’s “big dream.” It’s not just where you want to be in five or ten years; it’s about the impact you want to make on the world. A clear vision acts like a North Star, guiding every decision and keeping everyone rowing in the same direction. It’s what gets people excited to come to work in the morning.

2. Setting Objectives: Turning Dreams into Reality

This is where the rubber meets the road. It’s all well and good to have a grand vision, but how do you actually get there? Setting objectives means breaking down that big dream into smaller, achievable goals. It’s like planning a road trip: You need to know where you’re going (the vision), but you also need to map out the specific stops along the way (the objectives).

3. Resource Allocation: Playing with Building Blocks

Every company has limited resources – money, people, time. Resource allocation is about deciding how to best use those building blocks to achieve your objectives. It’s like playing a game of strategy: You have to figure out which moves will give you the biggest advantage. Sometimes that means making tough choices and sacrificing one thing to gain another.

4. Prioritisation: Juggling Act

In the real world, things rarely go according to plan. New opportunities pop up, unexpected challenges arise. Prioritisation is about being flexible and adapting to the situation. It’s like juggling: You have to keep all the balls in the air, but sometimes you need to focus more on one than the others to avoid dropping it.

In a nutshell:

- Visioning: Sets the direction

- Setting Objectives: Maps out the journey

- Resource Allocation: Provides the tools

- Prioritisation: Keeps things on track

These four pillars work together to create a solid foundation for any corporate strategy. They help companies stay focused, make smart decisions, and ultimately achieve their goals.

Corporate Strategy vs Business Strategy

It’s important to distinguish between corporate strategy and business strategy. While corporate strategy focuses on the big picture and direction, business strategy focuses on how a specific business unit will compete in its market through actions and initiatives, translating the corporate direction into actionable plans.

Think of it this way: corporate strategy is the overarching game plan, while business strategy is the playbook for each individual player on the team.

The Role of Corporate Strategy in Strategic Management

Corporate strategy is also a key component of strategic management. Strategic management encompasses a wide range of activities, from setting strategic goals to evaluating performance. The strategy provides the framework within which these activities take place.

Examples of corporate strategy in strategic management include:

- Environmental Analysis: Understanding the external and internal factors that can affect the company.

- Strategy Formulation: Developing strategic options and choosing the most suitable ones.

- Strategy Implementation: Putting the chosen strategies into action.

- Strategy Evaluation and Control: Monitoring progress, making adjustments, and ensuring alignment with the overall goals.

Effective strategic management requires a deep understanding of both the internal and external environments in which a company operates. Corporate strategists play a vital role in this process, providing insights into market dynamics, competitive landscapes, and potential opportunities and threats.

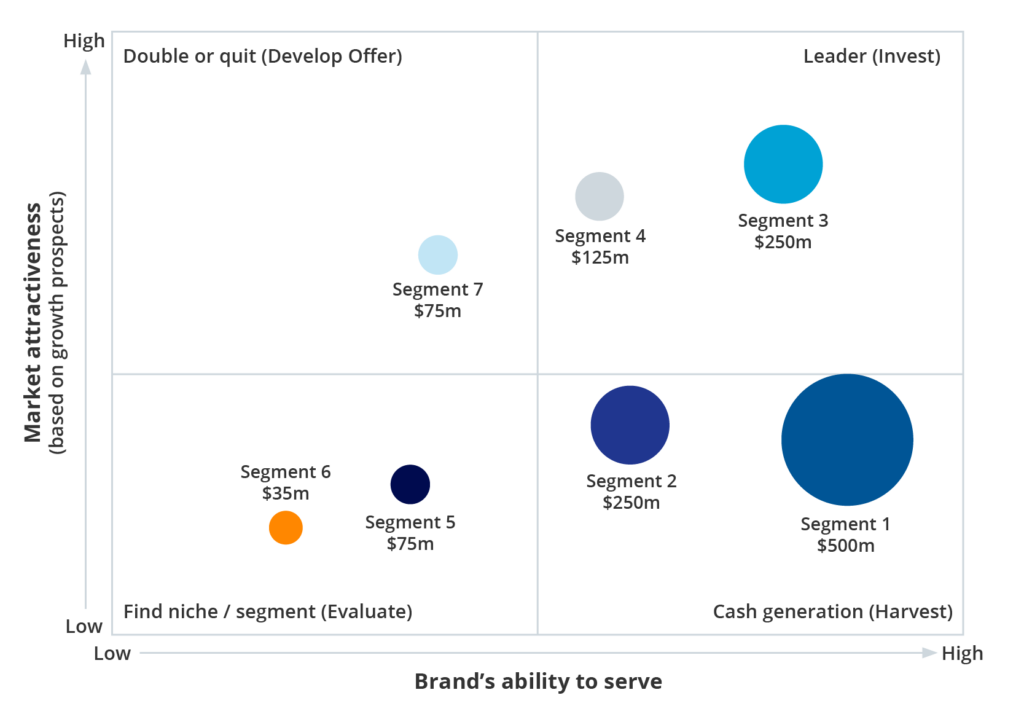

The Directional Policy Matrix

The Directional Policy Matrix (DPM) is a tool used to visualise and prioritise a company’s various products, services, or business units based on two factors: Market Attractiveness and Business Strength. It helps formulate strategies for each area by positioning them within a grid of four quadrants.

Market Attractiveness considers elements like market size, growth potential, profitability, and competitive landscape. Business Strength evaluates factors like market share, brand reputation, and cost efficiency.

The Four Quadrants and their Strategic Implications:

- High Market Attractiveness, High Business Strength (Invest/Grow): These represent the most promising opportunities, and companies should allocate resources to expand and maintain their leadership in these areas.

- High Market Attractiveness, Low Business Strength (Improve/Challenge): Though the market is attractive, the company’s position is weak. Focus should be on improving competitiveness through product innovation or aggressive marketing.

- Low Market Attractiveness, High Business Strength (Harvest/Maintain): The company holds a strong position in a less appealing market. Emphasis should be on maximising profits while cautiously investing.

- Low Market Attractiveness, Low Business Strength (Divest/Exit): These are the least promising areas, and companies should consider withdrawing or reallocating resources.

To use the DPM:

- Assess each business unit or product based on market attractiveness and business strength using relevant data.

- Plot each item on the matrix based on its assessment.

- Analyse the position of each item and develop appropriate strategies for each quadrant, from investment to divestment.

- Regularly review and update the DPM to adapt to changing market conditions and adjust strategies accordingly.

The DPM aids in strategic decision-making by providing a clear visual representation of a company’s portfolio, enabling informed prioritisation of investments and resource allocation.

Case Study: The Transformation of IBM

To further illustrate the impact of corporate strategy, let’s examine the transformation of IBM, a technology giant that has reinvented itself multiple times over its long history. In the 1980s, IBM was the undisputed leader in the mainframe computer market. However, the rise of personal computers and the internet posed a serious threat to its dominance.

In response, IBM embarked on a bold corporate strategy shift, divesting its PC business and focusing on higher-margin software and services. This strategic pivot enabled IBM to weather the storm and emerge as a leader in the new era of computing. Today, IBM is a global powerhouse in cloud computing, artificial intelligence, and cybersecurity. Its transformation is a testament to the power of corporate strategy.

The results of IBM’s strategic transformation are impressive. The company successfully transitioned from a hardware-centric business to a software and services-led model. Its revenues have stabilised, and its profitability has improved. Moreover, IBM has positioned itself at the forefront of emerging technologies, ensuring its relevance in the years to come.

This case study underscores the importance of adapting corporate strategy to changing market conditions. Companies that cling to outdated strategies risk becoming obsolete. By contrast, those that embrace change and proactively reshape their strategies can thrive in the face of disruption.

Case Study: The Rise and Fall of Kodak

Kodak, once a dominant player in the photography industry, failed to adapt to the digital revolution. Its corporate strategy remained anchored in film-based photography, despite the growing popularity of digital cameras. This strategic misstep led to Kodak’s bankruptcy in 2012.

This is the importance of anticipating and responding to changes in the external environment. A rigid corporate strategy can be detrimental in a dynamic marketplace. In short, you’ve got to be flexible or you’ll get left behind.

Corporate Strategy Example Techniques

The specific corporate strategy a company adopts will depend on its unique circumstances and goals. Here are some techniques to get you started:

1. Creating Synergy – The ‘1+1=3 Effect’

The 1+1=3 effect of synergy in corporate strategy refers to the phenomenon where combining two or more business elements results in a total impact that is greater than the simple sum of their individual contributions.

This “extra” value comes from the interaction and collaboration between the elements, leading to increased efficiency, innovation, market reach, or other strategic advantages.

For example:

- Company A has a strong brand and distribution network but lacks innovative products.

- Company B has a cutting-edge R&D department but struggles with marketing and sales.

- By merging (or partnering), they can leverage each other’s strengths: Company A gets access to new products,while Company B gains a wider market. The combined entity achieves greater success than either could have alone.

It’s a win-win situation where both companies get to play to their strengths and compensate for their weaknesses. In essence, synergy is about creating a whole that is more valuable than the sum of its parts. This is a key principle behind many corporate strategies, such as mergers & acquisitions, joint ventures, and internal collaborations.

2. Vertical Integration

Backward Integration: Moving “upstream” in the supply chain to gain ownership or control over raw materials or suppliers. Basically, you’re going straight to the source. For example: A bakery acquiring a wheat farm to ensure a steady supply of quality flour. By using this strategy, you will have reduced dependence on external suppliers, cost savings, better control over quality, and potential for differentiation through unique ingredients.

Forward Integration: Moving “downstream” in the supply chain to control distribution or sales channels. You’re getting closer to the customer. For example: A clothing manufacturer opening its own retail stores. The benefits of this means increased control over pricing, a better customer experience, access to valuable customer data, and brand building.

3. Horizontal Integration

Mergers: Two companies of similar size combine to form a new entity. An example of this is Exxon and Mobil merging to become ExxonMobil. Benefits include increased market share, economies of scale, reduced competition, and access to new technologies or markets.

Acquisitions: One company purchases another. Sometimes, it’s easier to buy than to build or compete! For example, Facebook acquiring Instagram. This can lead to rapid expansion, elimination of a competitor, acquisition of valuable assets or intellectual property.

4. Balanced Integration

This is strategically combining vertical and horizontal integration; adopting a balanced approach to integration, incorporating both vertical and horizontal strategies based on the specific needs and opportunities of the business. Imagine a technology company acquiring a supplier of key components (vertical integration), while also merging with a competitor to expand its product offerings (horizontal integration). This combines the advantages of both vertical and horizontal integration, providing greater control over the supply chain, access to new markets, increased market share, and potential for synergy and innovation. It’s about picking the right tool for the job, sometimes reaching up the supply chain, sometimes reaching out to competitors, all in the name of growth.

5. Diversification

Related Diversification: This is expanding into industries that share similarities with the core business. It’s like branching out, but staying within the comfort zone of the business you know. One example is a car manufacturer entering the electric vehicle market. The benefits of this are that you leverage existing capabilities, create synergies, and also reduce risk by not relying on a single market.

Unrelated Diversification: Entering entirely new and unrelated industries. This one’s a bit more adventurous. Imagine a tobacco company acquiring a food processing business. Benefits of this are that you spread your risk across diverse sectors, create new growth opportunities, and potentially gain access to new technologies or markets. It’s all about exploring new horizons.

6. Cost Leadership

This is where you focus on minimising costs throughout the value chain to offer products or services at the lowest price. For example: Walmart’s “Everyday Low Prices” strategy. The benefits: you attract price-sensitive customers, gain market share, and deter new entrants due to low margins. In short, it’s all about being the most affordable option out there, and that’s a powerful position to be in.

7. Differentiation

Differentiation is creating a unique and valuable offering that customers are willing to pay a premium for. It’s all about standing out from the crowd. For example: Apple’s focus on design and innovation. Think sleek and user-friendly. Benefits of this are brand loyalty, higher profit margins, and ability to withstand price competition.

8. Focus

Targeting a narrow market segment with specialised products or services. An example could be a luxury watchmaker catering to high-net-worth individuals. Benefits of this: deep understanding of customer needs, less competition, ability to charge premium prices. In essence, it’s about finding your perfect niche and catering to it exceptionally well.

9. Strategic Alliances & Joint Ventures

Partnerships between companies to achieve shared goals can be hugely beneficial. For example: Starbucks and Nestle partnering to expand the global reach of Starbucks products. It’s teamwork on a corporate level. Benefits: Shared resources and risk, access to new markets or technologies, and the ability to leverage each other’s strengths. It can be a win-win situation for everyone involved.

10. Innovation

Innovation includes continuously developing your products, services, or business models – offering genuinely new things. In other words, staying ahead of the curve and bringing something fresh to the table. A great example is Tesla’s focus on electric vehicles and renewable energy. This push from Tesla really shook things up in the automotive industry and all other companies had to adjust, introducing their own electric or hybrid vehicles to cater to the consumer mindset change. There are so many benefits of being an innovator, from first-mover advantage to increased market share to enhanced brand reputation.

Illustrating the Power of Corporate Strategy: Amazon Case Study

In its early days, Amazon focused solely on selling books online. However, it envisioned a future where Amazon would become the “everything store,” offering a vast array of products and services.

This ambitious strategy led Amazon to expand into new markets, such as electronics, apparel, and cloud computing. It also fueled a series of strategic acquisitions, including Whole Foods Market and Zappos.com. Today, Amazon is a global behemoth, with a market capitalisation exceeding a trillion dollars.

Amazon’s strategy has yielded remarkable results. It has disrupted multiple industries: Amazon’s entry into new markets often upended traditional business models, forcing competitors to adapt or perish. It also achieved a massive scale as Amazon’s relentless focus on growth has made it one of the largest companies in the world. From there they created immense value – Amazon’s market capitalisation has soared, making it one of the most valuable companies in history. Of course, this has all built a loyal customer base through their customer-centric approach, which has earned it the trust and loyalty of millions of customers worldwide.

This diversification strategy reflects Amazon’s corporate strategy decision to leverage its core competencies in technology and logistics to create a vast ecosystem of interconnected businesses.

In Summary

Understanding the principles of corporate strategy can equip you with valuable insights into the business world. Remember, it’s not about memorising jargon or frameworks. It’s about developing a strategic mindset and learning to see the big picture. By understanding the principles of corporate strategy and learning from successful examples, aspiring business leaders can gain valuable insights into how to navigate the challenges and opportunities of the corporate world.

Remember, corporate strategy is not a one-time event. It requires constant adaptation and refinement to keep pace with the ever-evolving business landscape. So, the next time you hear about a company’s strategic move, don’t just shrug it off. Think about the underlying corporate strategy and how it shapes the company’s future. You might be surprised by the depth and complexity of the strategic chess game being played. For more valuable insights you can check out our article on a killer value proposition.

Sources

- Porter, M. E. (1996). What is strategy? Harvard Business Review, 74(6), 61-78.

- Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley & Sons.

- Collis, D. J., & Rukstad, M. G. (2008). Can you say what your strategy is? Harvard Business Review, 86(4), 82-90.

- The Walt Disney Company Annual Report 2023.

- Amazon Annual Report 2023.