I’ve written before how boring marketing is costing businesses millions in wasted money every year.

Consultant Peter Field has found evidence that ‘boring’ marketing is 7x less effective than ‘interesting’ (emotional, fame generating) marketing. The Institute of Practitioners in Advertising’s database of 20 years of advertising effectiveness case studies shows that being interesting can deliver an immediate 7x effectiveness boost from the messaging alone.

So how can you be interesting?

Every piece of effective advertising is based on a novel human insight, followed by optimisation using data about what works and what doesn’t.

So what is an insight and where can we find one?

Insight.

Noun: an accurate and deep understanding. (The ability to have) a clear, deep, and sometimes sudden understanding of a complicated problem or situation.

There are three places to go for B2B marketing insights:

Category insights

These insights can be found in industry reports and from experts. They point to where the category is heading. Finding something surprising here is hard unless we redefine where the category is going.

Business insights

These insights are about what the businesses that buy the vendors want. Almost always to make money or save money. So we dig deeper to understand true motivations.

Buyer/user/team insights

Insights here are personal, particular to niches and powerful when uncovered and used. This is where you find the buyer’s perceptions of Value.

Hint: ‘Interesting’ is rarely to be found at a Category or Business level

Most organisations stop at Category or Business insights. They promote the ROI of their product within a category trend. This is shallow thinking – there’s no depth or richness to it and it’s not based on people. People buy people, so dig deeper to the human level. Marketing based on shallow insights looks and sounds like the category.

To be interesting you have to explore user problems and their Jobs to be Done. You understand what customers value most about you, triangulate this with your Vision and your Product and use this insight to position yourself as uniquely valuable within your market.

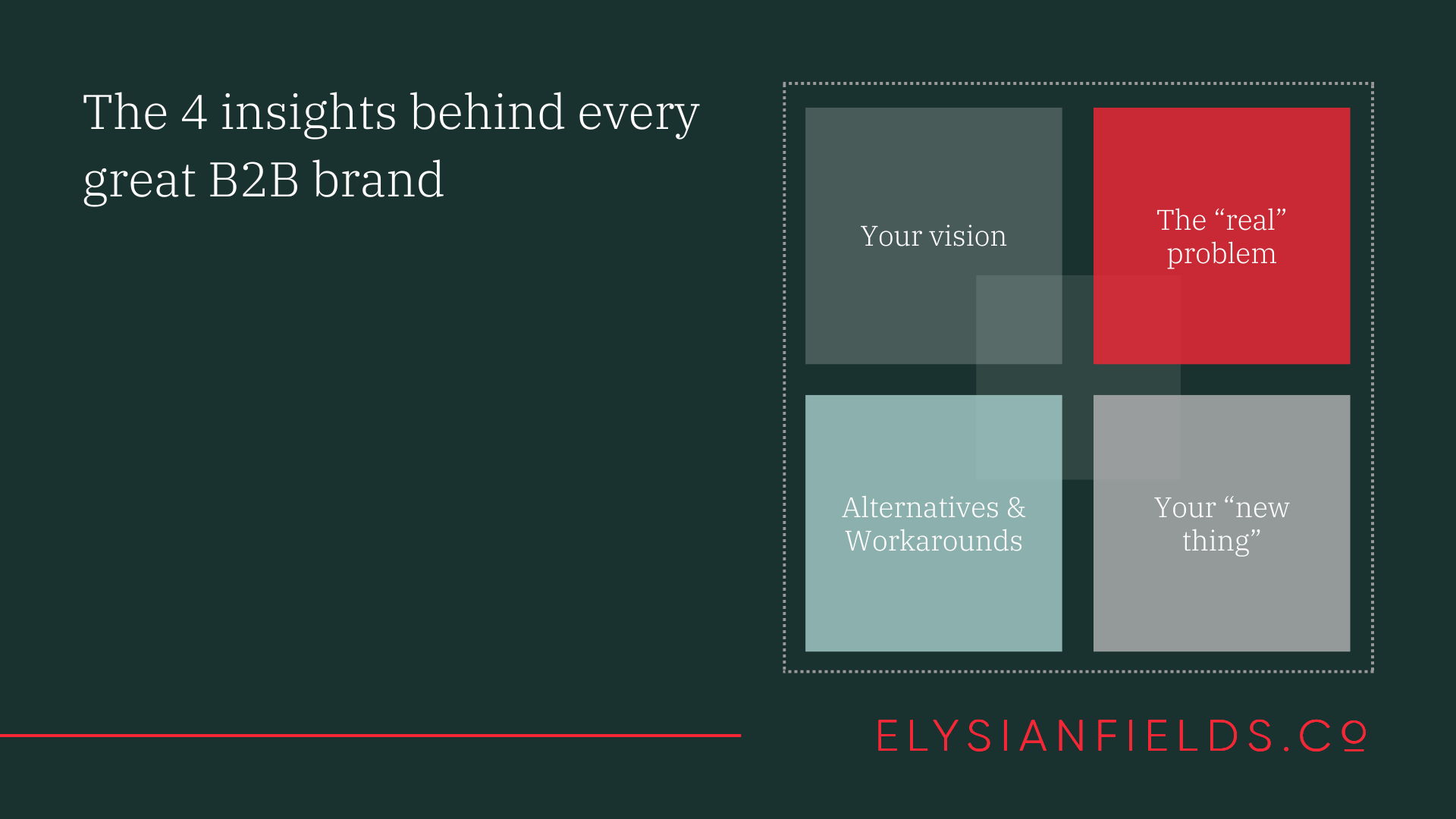

The 4 insights that are critical to great B2B positioning are:

1. Your vision

Your vision must resonate with the buyer as well as your team. Your grand vision must inspire all involved to go with you on a fast paced, innovative journey.

Going to Mars is an inspiring vision and a stretch for any team. Compare this to most company mission or vision statements: such as making the best widget to optimise shareholder value.

When a vision (and accompanying Missions, Goals and Values) buzzes with relevance for a certain buyer, magnetic attraction is possible. Partners seek you out, teams stay with you, recruitment gets easier and sales simpler.

You don’t need to be involved in space travel to construct a great vision.

Let’s take Calendly as an example. Calendly is a simple tool trying to elevate its role in the wider category of work productivity.

Their current vision states that they see scheduling as an opportunity to set the meeting up for success. Ok. That’s an insight and it’s just about credible. I don’t know if it inspires their staff to go to work each day or not. I’d suggest it needs more excitement.

A grander vision might lie in connecting ever more people through meetings, so business and the economy grows exponentially. Or in increasing the speed and ease of work so more meetings happen as if by magic.

You can see there are many areas one could explore, but the point is to find a vision that accelerates action and inspires your team to innovate faster to achieve the grand goal you’ve set. Your brand should attract, not bore. Your vision is the engine of this attraction.

2. The buyer’s ‘real problem’

What Job is the buyer trying to get done? What is stopping them? What are their Alternatives and Workarounds? This is where the real problem will lie. Look beyond Category or Business problems to the user’s daily workflows. This is where friction and pain always exists, and therefore opportunity for you.

We had a data ‘observability’ platform client; a technology that provides insight into where and how data gets broken within an organisation’s complex data workflows. The clue to their value was less in the data observability space (where all their competitors are), and more in the data manager’s daily workflows. The user sought an easier life, not ‘ROI from their data acquisitions’ as the category claimed.

Their Job to be done was to get the company to use data effectively, and data errors stopped that. Their real problem was political – how to get all teams to capture, use and profit from data, independently from the data team. Theirs was a people problem, not a data problem.

Take our friends at Calendly again. Arranging a meeting can take an hour of back and forth, if you add it all up and take into account the disruption from your ‘real’ work. So the real problem – the Job to be Done – is to get to meet the person, not arrange the meeting itself. So the Job Calendly can design the product around is to get the meeting in the diary, come what may. Buyers don’t have a ‘scheduling’ problem. They have a ‘meeting confirmed in the diary’ problem. It’s a subtle difference but a problem well stated will trigger all kinds of new avenues for innovation.

3. The buyer’s alternatives and workarounds

These are the current steps the buyer takes to get their Job done. You can map and rank them by factors such as pain severity, cost to the user, and market opportunity. They are the real competitors to your product’s adoption by your prospective buyers.

Look for insights about the emotions of those going through the process; what do their steps and decisions say about them and their social or political capital. What do they love or hate? What would they pay to avoid?

For Calendly, it’s the emails back and forth, calling up and arranging meetings by phone, or hiring a PA to do scheduling for you. All of these are time consuming and expensive. So the adoption risk of replacing them with a link and a few clicks should be seen as minimal.

However, there is a social aspect to consider! The emotional / reputational impact of sending a link in place of talking to someone about meeting up is potentially significant. This was highlighted by investor Sam Lessin in 2022 on twitter. He complained that sending a link suggests your time/schedule is more important than the recipient’s. It broke social etiquette, especially when pitching another for investment.

In this example one can see the very human implications of every step in getting a Job done. This is why the journey must be mapped and all the implications of each decision understood at a human level. Our emotions are messy, so buying decisions are often irrational. “No one ever got fired for buying IBM” is true – we avoid risks more than seek gains.

4. Your product’s ‘new thing’

This is the newsworthy innovation you’ve created. Even when your offer is an iteration on something familiar (and you don’t consider it a true innovation), you should seek to understand where your value for customers lies.

We see that most of the time it is in how you deliver the service or transformation you promise, not what your technology is or does.

For example, Calendly is a link, a booking form and a calendar integration. It’s ‘what’ is a bunch of standard code and some nice UX. Its value is in ‘how’ it gets meetings in diaries quicker and more easily than alternatives (emails, calls, a PA).

It has become ubiquitous because it was early in the game and its design is fun and pleasant – making the sender look modern and productive. Calendly makes you look good. So users want to send it, and a few clicks gets meetings in diaries in an efficient way. Its ‘how’ is good looks, simplicity, speed and ease.

Your product’s new thing will sit at the intersection of:

- Your founding product insight – the reason for your innovation

- Your technology – the code and approach you take

- Your design – the way you bring your tech to users

- The experience users enjoy as a consequence of your design and technology – the ‘how’

- Who it’s for – how niche you’ve gone

- The benefits they enjoy

We seek insights from all these areas to find your ‘new thing’. It’s a process of exploration – finding what is true about your product and user experience, and what customers value most.

It’s often hiding in plain sight and, when revealed, can lead to revelatory discussions about positioning, audiences, sales, marketing and product roadmaps.

This approach to insight generation is not just for marketing. It unlocks new energy and team alignment across the organisation. So it’s important to see this process as an opportunity to focus teams on customers (not just the product) and use this fresh insight to find new ways to solve their needs both now, and where they are heading to next.

These insights help teams look ahead to how to get customer Jobs done in the next 5 years (the common procurement cycle), so customers feel a commitment from your organisation to their aspirations and plans, not just their immediate buying needs.