There are many analytical ways to define market maturity stages. Our approach combines a few to provide a simple way to view the markets our clients are operating in.

Most buyers will struggle navigating new or emerging markets. But when a market’s hidden rules are understood, vendors can help confused buyers buy. It’s up to the vendor to make the market easy to navigate and justify it’s product or service’s role within it.

If the market has been poorly described to buyers they won’t know where to place the new product. They try to work out where new offerings sit in their current stack of solutions and, if there isn’t an obvious space for it the result is either a long buying cycle, or the vendor is ignored.

Many vendors make life harder for buyers by either re-inventing the category language (ignoring the current market they are entering), or unnecessarily imagining new niches for themselves to be kings of. ‘Category creation’ has a place, but it is not always suitable.

Marketing strategy can position a new offer as either 1) a Challenger in an existing category, outperforming incumbents, or 2) The Specialist solution for an underserved niche, or 3) the Inventor of a new solution for a previously unrecognised problem (category creation).

The latter works when a real new problem has been identified. Knowing which marketing strategy to adopt starts with understanding the market forces at play.

The market stages

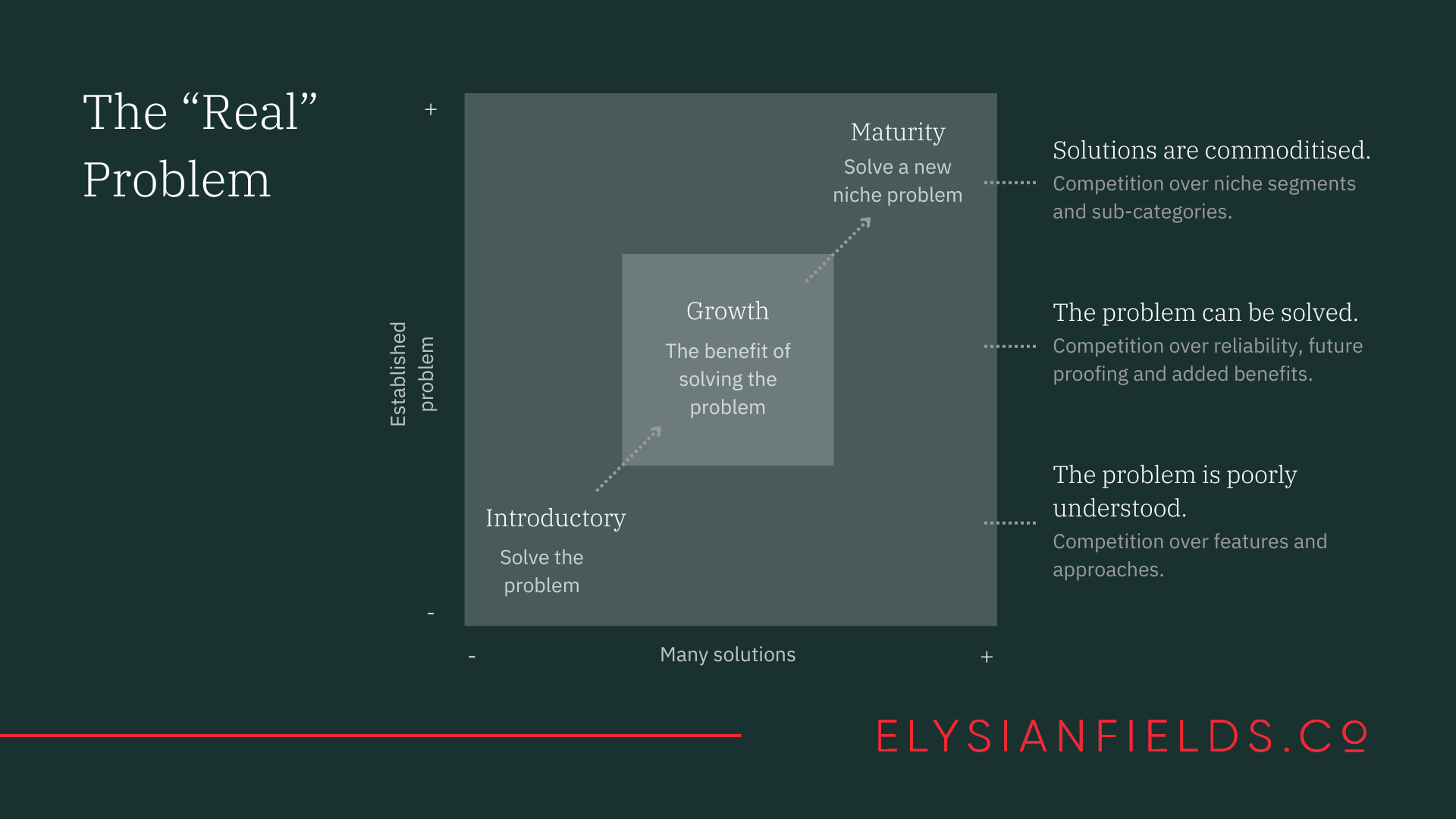

We see three market stages – from ‘Introductory’ with poorly defined problems and solutions, to ‘Growth’ where markets are forming around solutions, to ‘Maturity’ where solutions are becoming commoditised and new ‘nascent’ niches are appearing.

Here’s how to spot where your solution is at and how your market may respond to it:

Introductory Stage

At the Introductory Stage, the market is still in its infancy, the problem (whatever it is) is not fully understood, and few solutions are available. It’s a stage where vendors are competing over problem definitions and possible approaches to solving it. Current examples are robo-taxis, AI assistants, VR and quantum computing.

In summary:

- Problem not fully understood.

- Early adopters funding experimentation.

- Competition over ways to solve the problem

- Marketing sells the problem

Growth Stage

The problem has mostly been agreed upon and solutions are crossing the chasm to early mainstream audiences. Competition emerges over reliability, future proof approaches and the benefits of solving the problem. Market start to fragment. Examples include electric cars competing over charging networks and range, personalised health apps competing over hardware and recording methods, and data observability platforms competing over reporting algorithms

In summary:

- The problem is solvable

- Vendors sell the benefits of solving the problem

- Increased solutions and capabilities identify niche buyers

- Marketing de-risks buying for early mainstream buyers

Maturity Stage

The Maturity Stage is when problems have been well-defined and solutions have become commoditised. It the phase of most intense competition as new players find niche segments. Redefinition of the problem (and category) becomes a favourite means of differentiation. Examples of mature markets include most CPG categories, most personal computing hardware categories, many SAAS categories, retail, hospitality, and so.

- Problems have been deeply explored

- Solutions are commoditised

- Intense competition leading to price deflation

- Creation of new subcategories and niche problems

- Marketing creates differentiation for niche target buyers

Finding the hidden rules of each market stage

Many fast moving markets have players in all three market stages. For example, the cyber security market has sellers and buyers exhibiting Introductory, Growth and Maturity behaviours. In cyber security, players on both sides adapt to each other’s tactics so buyers are constantly comparing novel but proven approaches (Growth) while seeking the comfort and ease of consolidation (Maturity).

Customer interviews can be used to understand the Jobs buyers are looking to get done through the frame of each market stage.

For example, buyers of larger cyber security platforms are seeking to protect their own careers as much as their organisation’s data. While buyers of Introductory or Growth methods are seeking the highest level security they can procure and are happy to combine vendors. While Personas will be similar, each buyer’s attitude to risk, as expressed through their Jobs to be Done, Pains and Gains, will be quite different.

Market understanding can guide Go To Market strategy. We worked with a global industrial battery power business. Some of their geographies enjoyed greater market maturity than others. Some Asian countries were pioneers of battery power, while the US are currently laggards. By understanding the Jobs, Pains, Gains and Alternatives in each we could advise on a Go To Market approach that differed in each market.

We create three different GTM strategies with very different messaging for each, replacing the one size fits all approach previously deployed. A single brand position united all three.

I go into more detail about buying needs in Webinar 5 – Jobs to be Done. Watch it here

If you can’t wait to unearth the hidden insights that will guide your team through market penetration, get in touch with us